In a world of digital transactions and contactless payments, physical cash might seem like a thing of the past. Yet when disaster strikes, power grids fail, and ATMs go offline, cash becomes one of the most valuable tools you can have.

Whether you’re facing a regional blackout, a hurricane, or an unexpected financial disruption, having a dedicated emergency cash stash ensures you can still access food, fuel, and other necessities when systems go down. This guide explains how much cash you should keep, where to store it, and how to maintain your stash over time — so you’re ready for anything.

Why an Emergency Cash Stash Matters

When electronic systems fail, digital money becomes useless. In emergencies like power outages, economic freezes, or cyberattacks, banks and payment processors may go offline — sometimes for days. Cash gives you the flexibility to pay for essentials, barter locally, or evacuate safely when cards and apps no longer work.

Consider these real-world scenarios where cash is essential:

- Power outages: ATMs and credit card machines stop working.

- Natural disasters: Floods or storms disrupt banking infrastructure.

- Economic turmoil: Governments impose withdrawal limits or bank holidays.

- Evacuations: You may need to buy fuel, lodging, or supplies in cash-only zones.

Having immediate access to physical currency can mean the difference between dependence and independence in an emergency. For complete readiness, pair your cash plan with a 72-Hour Emergency Kit to cover your essentials while systems recover.

How Much Cash Should You Keep?

There’s no universal amount that fits everyone — it depends on your lifestyle, family size, and regional risks. However, having a structured approach helps you determine your ideal reserve.

1. Your Basic Cash Reserve

Start small, then scale up as your budget allows. The goal is to have enough to cover a few days’ worth of basic expenses — food, transportation, and shelter.

Recommended Starting Point:

- At least $100–$200 in small bills ($5s, $10s, $20s).

- Enough to buy fuel, groceries, or emergency supplies locally.

For households with dependents, aim higher:

- Individuals: $300–$500

- Families: $1,000–$2,000

If you rely on medication or live in an area prone to disasters, consider extending your reserve. You’ll thank yourself later when stores or ATMs aren’t accessible.

This principle aligns with preparedness strategies discussed in Essential Items for Your Emergency Preparedness Kit — where redundancy and accessibility are key to survival.

2. Diversify by Denomination

In emergencies, small bills are king. Large denominations like $50s and $100s are often hard to break, especially when systems are down.

Optimal Mix:

- $5 and $10 bills for everyday transactions

- $20 bills for fuel and groceries

- A few $50s for large, urgent needs

Avoid relying entirely on coins or large notes. Keep a balanced mix that lets you handle both small and moderate purchases.

3. Tailor It to Your Environment

Your location affects your ideal cash stash size. Urban residents may need less because of local access to services, while rural or high-risk areas may require more.

Examples:

- Rural areas: Keep $1,500–$3,000 (limited nearby banks or stores).

- High-disaster zones (e.g., coastal areas): $2,000+ for extended outages.

- Travelers and remote workers: Maintain $300–$500 in your vehicle at all times.

Complement this with emergency communication gear from Key Features to Look for in an Emergency Radio so you can monitor financial or evacuation updates.

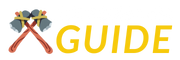

Where to Store Your Emergency Cash Safely

Your storage strategy must balance security, accessibility, and discretion. Cash should be protected from fire, water, and theft — but still easy to retrieve when needed.

1. Home Storage Solutions

Keep the majority of your emergency cash safely at home in a secure, hidden location.

Recommended Tools:

- SentrySafe Fireproof and Waterproof Safe – Protects from heat, floods, and theft while keeping cash and documents accessible.

- Hidden Compartments: False books, hollow furniture, or decoy containers work well for concealing smaller amounts.

- Diversify Locations: Don’t keep all your money in one place — split between two or three hidden spots.

For maximum protection, pair your safe with insights from Organizing Your Emergency Documents to store identification and insurance policies alongside your cash.

2. On-the-Go Storage Options

If you’re evacuating or traveling during a crisis, you’ll need a portable way to carry cash discreetly.

Best Picks:

- Peak Gear Travel Money Belt – RFID-blocking belt perfect for concealing small bills.

- Venture 4th Neck Wallet – Slim and breathable pouch ideal for quick access to documents and emergency funds.

Combine this with evacuation planning from Building a 72-Hour Survival Kit to ensure all critical resources are ready to grab and go.

3. Vehicle Stash: A Mobile Backup

Vehicles can serve as secondary storage for small cash reserves, especially if you’re caught away from home during a disaster.

Guidelines:

- Hide small denominations in an envelope or emergency tin.

- Use discreet areas (under seats, behind panels).

- Rotate periodically to prevent heat damage.

Store cash alongside essential car supplies from Assembling the Perfect Car Emergency Kit for Winter so you’re ready year-round.

How to Keep Your Cash Fresh and Secure

Even money can degrade over time if left unchecked. Follow these best practices to keep your cash stash clean, current, and functional:

- Inspect quarterly for damage or wear.

- Replace old or torn bills with crisp ones.

- Avoid plastic wraps — moisture can trap and warp paper currency.

- Store in airtight, waterproof bags within your safe.

Airtight storage techniques are similar to preserving dry food in Long-Term Food Storage for Beginners: The Complete Guide — both rely on controlling air, temperature, and moisture to ensure longevity.

Creating Layers of Access (Redundancy Strategy)

Having one cash stash isn’t enough. Divide your reserves into layers based on how urgently you might need them:

- Quick Access (Immediate Needs):

- $100–$200 in wallet or money belt

- Used for quick expenses like gas or food

- Short-Term Reserve (1–3 Days):

- $300–$500 in a go-bag or vehicle safe

- Long-Term Reserve (Home Safe):

- $1,000+ for extended emergencies

This layered system mimics how preppers build their Disaster Supply Kit — ensuring that even if one cache is lost, others remain intact.

Common Mistakes to Avoid

Even well-intentioned preppers make errors with cash management. Avoid these pitfalls:

- Keeping large bills only: Hard to use in small transactions.

- Storing cash in obvious places: Drawers, closets, and under mattresses are easy targets.

- Forgetting to rotate bills: Old currency can become worn or even obsolete.

- Neglecting fire/water protection: A single flood or blaze can wipe out your savings.

- Sharing details with too many people: Limit knowledge of your stash to one trusted individual.

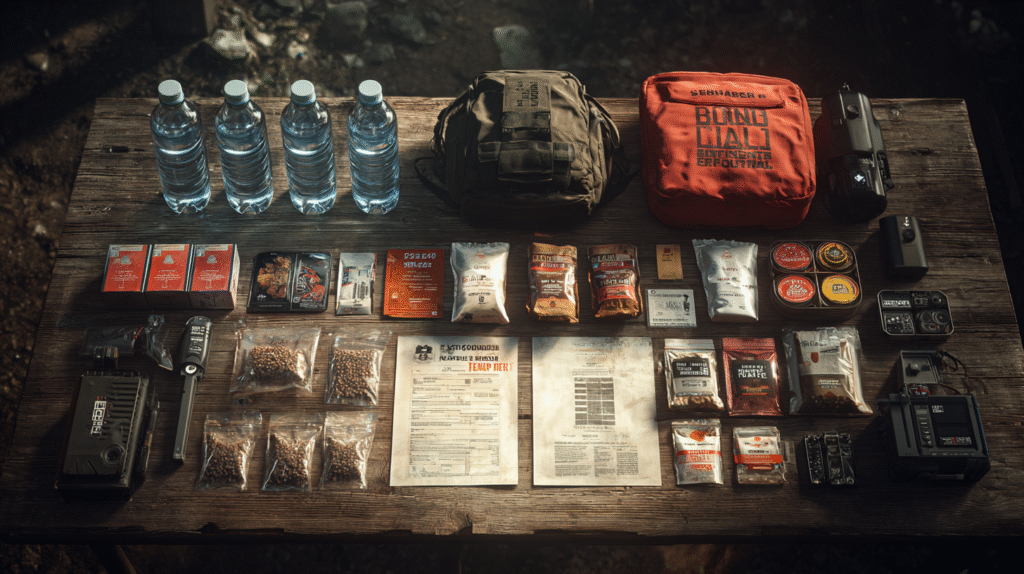

Integrating Cash with Your Overall Preparedness Plan

Your emergency cash strategy should work alongside other aspects of survival readiness — not replace them. Combine it with:

- Food and water storage from Best Survival Food Kits for Preppers: Top Picks for 2025

- Power and communication tools from Key Features to Look for in an Emergency Radio

- Lighting and shelter from Emergency Shelter Options: From Tents to DIY Solutions

Together, these form a holistic emergency strategy that covers every base — sustenance, security, and stability.

Affiliate Product Recommendations for Your Emergency Cash Setup

- SentrySafe Fireproof and Waterproof Safe – Protects cash and documents from disasters.

- Peak Gear Travel Money Belt – Keep small bills secure while traveling or evacuating.

- Venture 4th Neck Wallet – Slim, comfortable, and ideal for bug-out scenarios.

- Amazon Basics Fire Resistant Safe Box – Affordable alternative for long-term home storage.

These options ensure your financial lifeline remains intact, no matter what happens.

Final Thoughts

An emergency cash stash isn’t about fear — it’s about foresight. In an increasingly digital world, having real money in hand gives you an edge when systems fail. By building a layered cash strategy, securing it properly, and keeping it fresh, you create financial resilience that digital tools can’t match.

Start today by setting aside a small reserve, choosing a secure storage method, and reviewing your preparedness plan quarterly. When the unexpected happens, you’ll have something far more powerful than plastic or pixels — peace of mind and control.